How does early-stage venture capital shape not only the success of startups but also the future of industries?

This week, Andrew and Daniel are joined by Michael Cardamone, CEO and Managing Partner of Forum. Michael discusses the impact of early-stage venture capital, the importance of investing in diverse founders, and the potential societal impact of the startups they support. He delves into the venture studio model and highlights how his firm helps launch innovative companies in sectors like healthcare and tech. With practical advice for both investors and entrepreneurs, this episode provides a unique look into the world of venture capital and the driving forces behind successful early-stage investments.

[00:01 - 05:07] The Venture Capital Landscape

- Investing in companies before others believe in them.

- Creating jobs and impacting the economy at large.

- Venture capital's role in driving innovation across industries.

[05:08 - 10:48] Impact through Diversity

- Forum Ventures focuses on building diverse teams early on.

- Tracking diversity KPIs helps improve the inclusivity pipeline.

- Diverse teams lead to more innovative and resilient businesses.

[10:49 - 15:15] Investing in Healthcare and Tech

- Startups in healthcare can drive large-scale impact.

- Companies like Blooming Health and Remo Health help people manage care at home.

- AI-based solutions are transforming diagnostics in cancer care.

[15:16 - 20:56] The Venture Studio Model

- Forum Ventures creates companies from scratch through a venture studio.

- Deep founder-market fit is crucial for success.

- Early customer feedback and strong CEO leadership drive success.

[20:57 - 26:56] Advice for Aspiring Investors and Founders

- Understanding your unique advantage is key to succeeding in venture capital.

- Founders should leverage industry experience and network connections.

- Storytelling and vision play a pivotal role in raising capital.

Connect with Michael!

https://www.forumvc.com/

Key Quotes:

"We look closely at how we can drive more diversity and inclusion in our pipeline." – Michael Cardamone

"It’s not just about the businesses we invest in but also about the people behind them and the jobs they create." – Michael Cardamone

Visit our website https://www.birgo.com/to learn more about High-Quality Recession Resistant Assets for the Everyday Investor

--

LIKE, SUBSCRIBE, AND LEAVE US A REVIEW on Apple Podcasts, Spotify, Google Podcasts, YouTube, or whatever platform you listen on. Thank you for tuning in, and Stay Tuned for the next episode COMING SOON

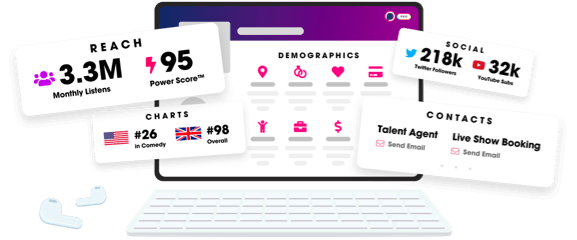

Unlock more with Podchaser Pro

- Audience Insights

- Contact Information

- Demographics

- Charts

- Sponsor History

- and More!

- Account

- Register

- Log In

- Find Friends

- Resources

- Help Center

- Blog

- API

Podchaser is the ultimate destination for podcast data, search, and discovery. Learn More

- © 2024 Podchaser, Inc.

- Privacy Policy

- Terms of Service

- Contact Us